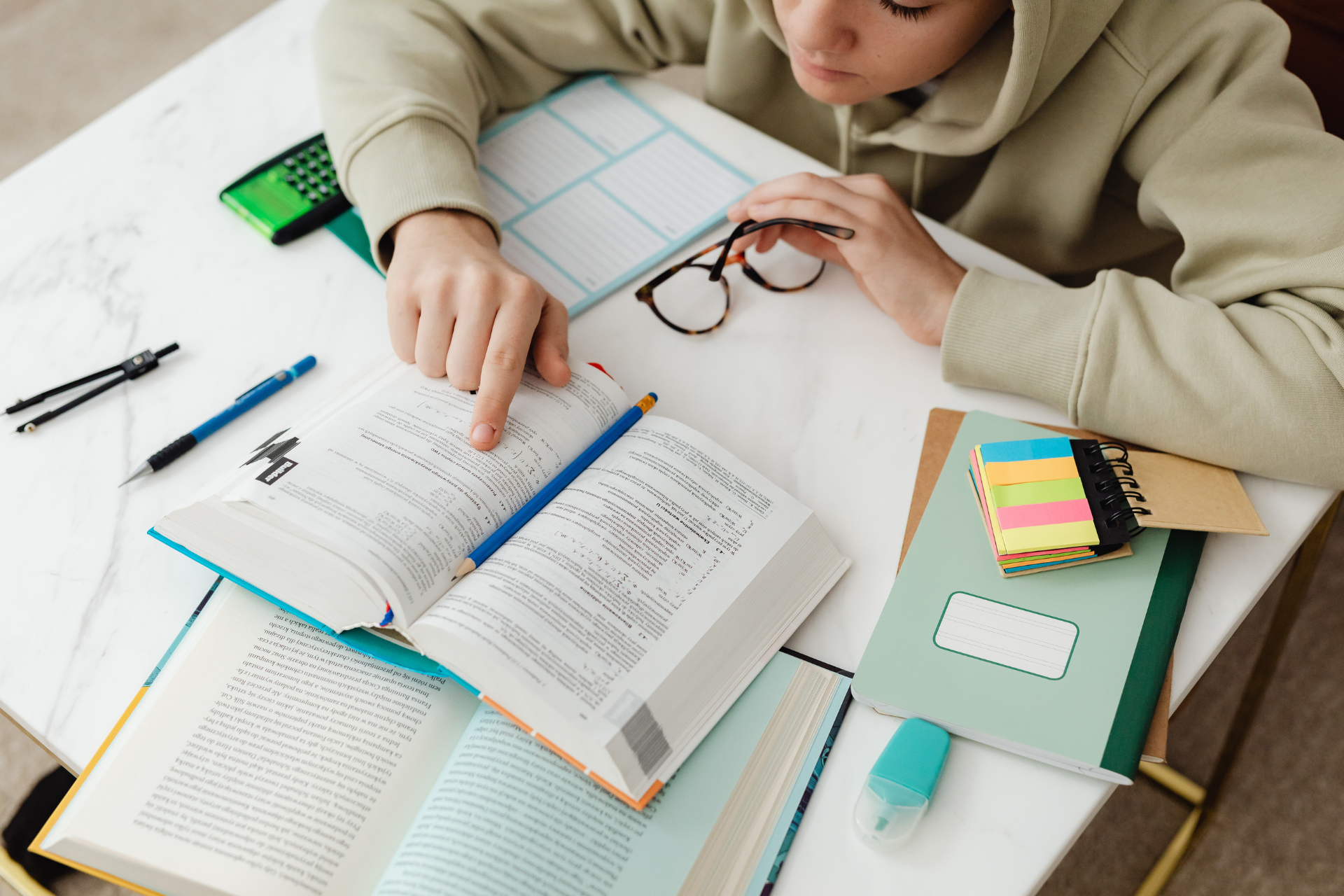

Maximizing Your Education: A Guide to Tax Incentives

Education is a powerful tool that can open doors to a brighter future, but it often comes with a hefty price tag. Fortunately, the U.S. tax code offers a range of incentives to help alleviate the financial burden of higher education. Whether you're paying for your own education or supporting a family member's academic journey, understanding these tax benefits can make a significant difference in your financial planning. In this blog post, we'll explore tax incentives for higher education, including the American Opportunity Credit, Lifetime Learning Credit, deductions for student loan interest, and the often-overlooked aspect of forgiven student loan debt.

American Opportunity Credit and Lifetime Learning Credit

The American Opportunity Credit and Lifetime Learning Credit are two key tax incentives designed to assist families with the costs of higher education. These credits can provide a substantial reduction in your tax liability, making education more affordable. Here's what you need to know about each:

1. American Opportunity Credit: This credit, formerly known as the Hope Credit, is aimed at undergraduate students pursuing their first four years of higher education. The credit covers qualified tuition and related expenses, such as textbooks and supplies. Eligible students include you, your spouse, or your dependents.

- Benefit: The American Opportunity Credit can be worth up to $2,500 per eligible student.

- Income Limits: It's important to note that the ability to claim this credit gradually phases out as your income increases. Be sure to check the current income limits to see if you qualify.

2. Lifetime Learning Credit: Unlike the American Opportunity Credit, the Lifetime Learning Credit is available to a broader range of students. It covers not only undergraduate but also graduate and professional degree courses. This credit is designed to help individuals improve their job skills or pursue lifelong learning opportunities.

- Benefit: The Lifetime Learning Credit can provide a tax credit of up to $2,000 per tax return.

- Income Limits: Just like the American Opportunity Credit, the Lifetime Learning Credit has income limits that determine eligibility.

Student Loan Interest Deduction

If you've taken out student loans to finance your education or that of a family member, there's a tax benefit for you too. You may be able to deduct the interest you pay on qualified student loans. Here are the key details:

- Deduction Amount: The student loan interest deduction allows you to deduct up to $2,500 of interest paid on a qualified student loan.

- Income Limits: As with the education credits, there are income limits for this deduction, and it starts to phase out as your income increases.

- Adjustment to Income: Unlike itemized deductions, the student loan interest deduction is claimed as an adjustment to income, meaning you can benefit from it even if you don't itemize deductions on your tax return.

Forgiven Student Loan Debt

While it's crucial to take advantage of tax incentives to lower the cost of education, it's equally important to understand the implications of forgiven student loan debt. Generally, forgiven debt is considered taxable income. However, there's an exception for certain student loans.

If your student loan debt is forgiven under specific forgiveness programs, such as Public Service Loan Forgiveness (PSLF) or Teacher Loan Forgiveness, you may not have to include the forgiven amount in your taxable income. This can be a significant relief for borrowers who have dedicated themselves to public service or teaching.

Navigating the complexities of the U.S. tax code can be challenging, but understanding the tax incentives available for higher education can lead to substantial financial savings. Whether you're pursuing your own education or supporting a family member's academic journey, be sure to explore the American Opportunity Credit, Lifetime Learning Credit, and the student loan interest deduction. Additionally, stay informed about forgiveness programs that can provide relief from taxable forgiven debt. By making informed decisions, you can make higher education more affordable and attainable for you and your loved ones.